Discover Reliable Lending Solutions for All Your Financial Requirements

In navigating the vast landscape of economic services, discovering reputable car loan service providers that provide to your certain requirements can be a daunting task. Let's explore some crucial factors to consider when seeking out finance services that are not only dependable however also tailored to satisfy your special economic needs.

Types of Personal Fundings

When taking into consideration personal fundings, individuals can pick from numerous kinds customized to meet their specific monetary demands. One usual kind is the unsafe personal car loan, which does not need security and is based upon the consumer's credit reliability. These car loans normally have greater rate of interest rates as a result of the enhanced risk for the lending institution. On the various other hand, safeguarded personal financings are backed by security, such as a vehicle or interest-bearing accounts, leading to lower rates of interest as the lending institution has a form of safety. For people aiming to combine high-interest financial obligations, a financial obligation combination funding is a feasible alternative. This kind of loan incorporates multiple financial obligations into a single regular monthly repayment, commonly with a lower passion rate. Additionally, individuals seeking funds for home remodellings or significant acquisitions may select a home improvement funding. These car loans are particularly made to cover expenditures associated with boosting one's home and can be protected or unprotected depending on the lender's terms.

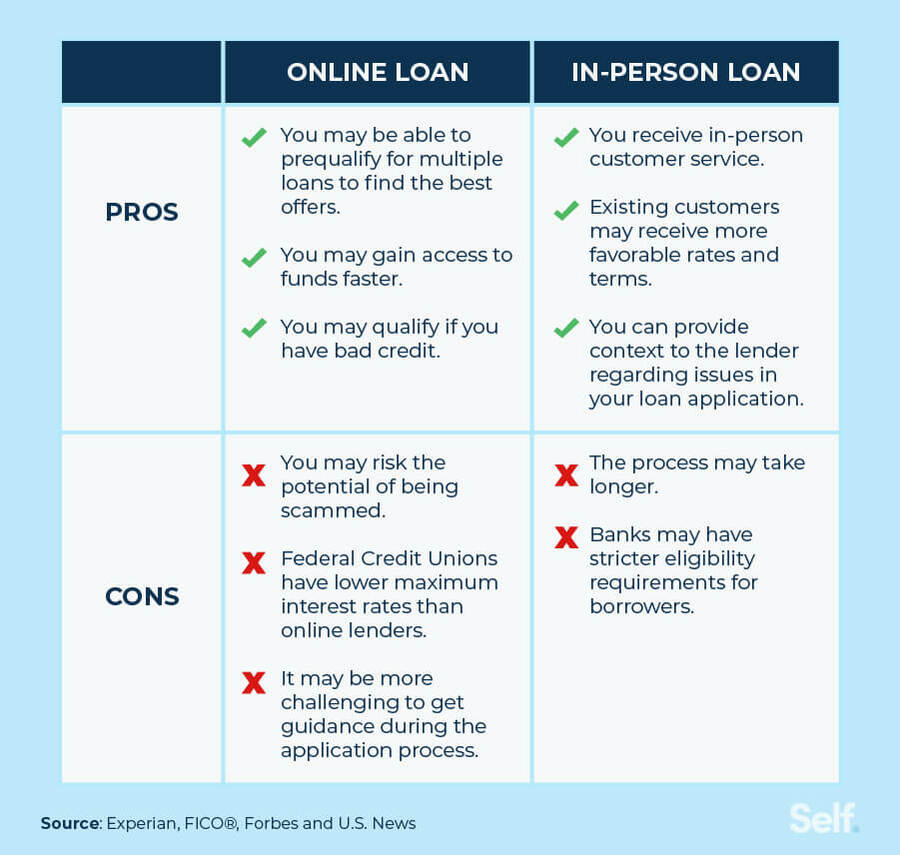

Benefits of Online Lenders

Understanding Lending Institution Options

Credit report unions are not-for-profit economic cooperatives that provide a range of products and solutions comparable to those of banks, including cost savings and checking accounts, finances, credit rating cards, and a lot more. This possession framework frequently converts right into reduced fees, competitive rate of interest prices on lendings and cost savings accounts, and a strong focus on client service.

Credit unions can be attracting individuals seeking an extra tailored method to financial, as they typically focus on member complete satisfaction over earnings. Additionally, cooperative credit union frequently have a strong area existence and may offer financial education resources to assist participants boost their economic literacy. By recognizing the alternatives offered at lending institution, individuals can make informed choices about where to leave their monetary demands.

Exploring Peer-to-Peer Lending

Peer-to-peer lending systems have actually acquired popularity as an alternative form of borrowing and investing in recent times. These platforms connect individuals or organizations in requirement of funds with financiers ready to offer money for a return on their financial investment. One of the essential destinations of peer-to-peer loaning is the capacity for lower rate of interest contrasted to standard banks, making it an appealing alternative for borrowers. Additionally, the application procedure for obtaining a peer-to-peer funding is normally streamlined and can result in faster accessibility to funds.

Investors likewise profit from peer-to-peer lending by possibly earning greater returns contrasted to traditional investment alternatives. By eliminating the middleman, financiers can straight money borrowers and get a portion of the rate of interest settlements. However, it is necessary to keep in mind that like any type of investment, peer-to-peer financing brings integral threats, such as the possibility of consumers back-pedaling their loans.

Entitlement Program Programs

Amidst the evolving landscape of economic services, an important element to take into consideration is the world of Entitlement program Programs. These programs play a critical duty in providing financial assistance and support to individuals and businesses during times of need. From unemployment insurance to have a peek at this site bank loan, entitlement program programs intend to relieve economic burdens and advertise financial stability.

One prominent instance of an entitlement program program is the Small company Management (SBA) fundings. These finances offer favorable terms and low-interest prices to aid small companies grow and browse challenges - merchant cash advance with same day funding. Additionally, programs like the Supplemental Nutrition Help Program (SNAP) and Temporary Support for Needy Households (TANF) give important assistance for people and families dealing with financial difficulty

In addition, entitlement program programs extend beyond monetary help, encompassing housing assistance, health care subsidies, and academic grants. These efforts intend to resolve systemic inequalities, promote social welfare, and ensure that all citizens have access to fundamental requirements and chances for innovation. By leveraging federal government assistance programs, people and services can weather monetary storms and strive towards a more secure monetary future.

Final Thought